Auto-enrolment

Home » Advice for Small Business »

The law on workplace pensions has changed. All employers are legally required to automatically enrol certain staff into a pension scheme and make contributions. The clock is ticking. So unless you take action now you may unwittingly drift towards non-compliance or leave yourself vulnerable to rash choices that may damage the business in the longer term. RMT can help guide you through the process.

Automatic enrolment: the main steps

12-9 months before your staging date

i. What is your staging date – ring us with your PAYE reference and we will let you know

ii.Provide a point of contact within your organisation and register on The Pension Regulator Website

9-0 months before your staging date

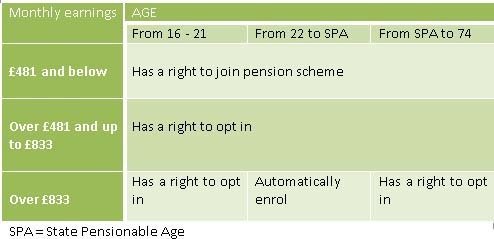

i. Assess your workforce and check the impact that auto-enrolment will make to your business

ii. Choose your software

There are many products out there, such as Sage Payroll, which will help you to assess your workforce and track the ages of staff and their salaries to tell you what you need to do for each of them on every payroll run. Alternatively RMT can offer you a payroll service and assist you in this process.

iii. Choose a pension scheme

If you have an existing scheme for your workforce (perhaps called a ‘stakeholder scheme’) you should check with your pension provider to see if you can use it for automatic enrolment. If you need to open a new scheme, make sure you approach a pension provider in good time because they will be taking on thousands of employers in the coming months. Don’t leave it too late.

At staging and beyond

i. Automatically enrol your staff

At your staging date you will need to identify which members of staff to automatically enrol and which will have a right to join your pension scheme on request. By this point you will already know what information your scheme provider wants from you, so make sure you send this to them promptly. Make sure you pay the contributions across to the pension scheme before the deadline your provider has given you.

You must write to your staff about how automatic enrolment affects them within 6 weeks of your staging date’

ii. Complete your declaration of compliance (registration)

You must complete your declaration of compliance when you’ve automatically enrolled your members of staff. This confirms to The Pension Regulator that you have fulfilled your legal duties. You may find it helpful to track your progress by starting your declaration early. It must be completed up to five months after your staging date.

iii. Maintain records

As with real-time PAYE, you must keep records of your automatic enrolment activities. This will include the information you send to your pension provider, and copies of any opt-out requests you receive.

iv. Fulfil ongoing responsibilities

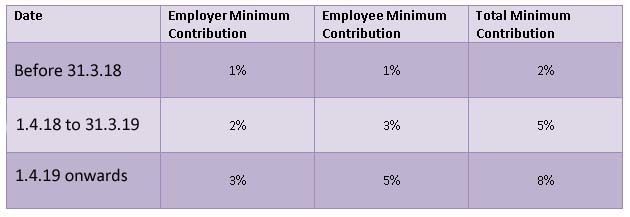

For automatic enrolment there are minimum contributions you must pay in order to comply with your duties. These are a percentage of earnings and are shown in the table below.

Your employee may also pay pension contributions, which you will need to make sure you deduct and pay to the scheme on time. Automatic enrolment is not just something that happens at your staging date – it is an ongoing duty. You’ll need to check every payday to see whether any of the members of staff who weren’t automatically enrolled are now entitled to be put into the pension scheme (for example if they have reached their 22nd birthday). After you have automatically enrolled your staff members, they may ask to ‘opt out’ of the pension scheme. You must then stop deductions of contributions and arrange a refund of any contributions they have paid to date.

Staff who have not been automatically enrolled may ask to join the scheme. If you receive such a request, your software should help you process this. Automatic enrolment will be ‘business as usual’, just like real-time PAYE or filing your employer return with HMRC.

The time to act is now

Auto-enrolment is a straight forward process so long as employers take the right steps in the right time frame. We cannot stress enough that you need to start planning at least 12 months prior to your staging date. Don’t assume that your current pension provider will convert your current pension scheme to a Qualifying Work Related Pension Scheme. The sooner you find this out the better. Have the opportunity to control your costs and meet your legal duties, whilst managing your business. Make us your initial point of contact. We can refer you to all the right people and get this process on the right track.

RMT can help you throughout the Auto-Enrolment process. Call Anthony Josephs for a free initial discussion on 0191 2569500

In this section